Whether you’re still in school, in your prime or about to retire,

You need financial peace to live a happy life.

And there is no time to begin but NOW.

Highly sought-after financial planning consultant, Randell Tiongson, who also happens to be a dear friend, invited me to his workshop recently, Steps to Financial Peace. The opportunity to attend and listen to the counsel of someone known for his know-how in investments was too good to pass up. And truth to tell, there was a little voice inside me saying that maybe blogging was another way to share stored-up knowledge from almost two decades in the corporate world.

Some Things to Keep in Mind

When you invest, your goal is to earn at a rate higher than inflationary trends. If all of one’s extra money is in savings or time deposit, which at the moment hovers in the range of less than 1% to 2%, depending on which bank you use, your money is really losing value while it is sitting there because your purchasing power is being eroded by an inflation rate that is higher than the interest rate you get.

80% of what is needed for investing is BEHAVIORAL. People need to get into an investment mindset. Randell mentioned that even those who are themselves in the financial industry are not spared from financial woes. Many know how to preach but do not apply the principles to themselves.

There is what is known as a Filipino vicious cycle — the parents spend everything they have on the kids, ending up with no savings of their own. Then when they are old and medical issues begin to crop up, they become fully dependent on the children to support them. And the cycle continues. Some will say but that is because we are family-oriented and that supporting elders is a natural obligation. This mindset, however, results in generations of people who have no financial peace.

55% of families in the Philippines do not own their own homes. Many have been renting for decades with nothing to show for the money spent.

Based on statistics, women outlive men. For women who are totally dependent on their husbands for the family’s expenses, this is a scary thought. Randell emphasizes these to both: “Women, prepare financially because you will outlive your husbands. Men, prepare your wives financially.”

Creating a retirement nest TAKES TIME. If you are a fresh graduate on your first job, it is never too early to think of building a retirement nest. If you’re 5 years away from retirement and still got no retirement nest, it may seem quite late in the game. But that should not stop you from doing something about it RIGHT NOW to mitigate any negative effects down the road.

Creating a retirement nest TAKES TIME. If you are a fresh graduate on your first job, it is never too early to think of building a retirement nest. If you’re 5 years away from retirement and still got no retirement nest, it may seem quite late in the game. But that should not stop you from doing something about it RIGHT NOW to mitigate any negative effects down the road.

How does one begin the journey to financial peace then?

I believe that NOW is always the best time to start one. As the saying goes: Better late than never. Randell gave some starter tips:

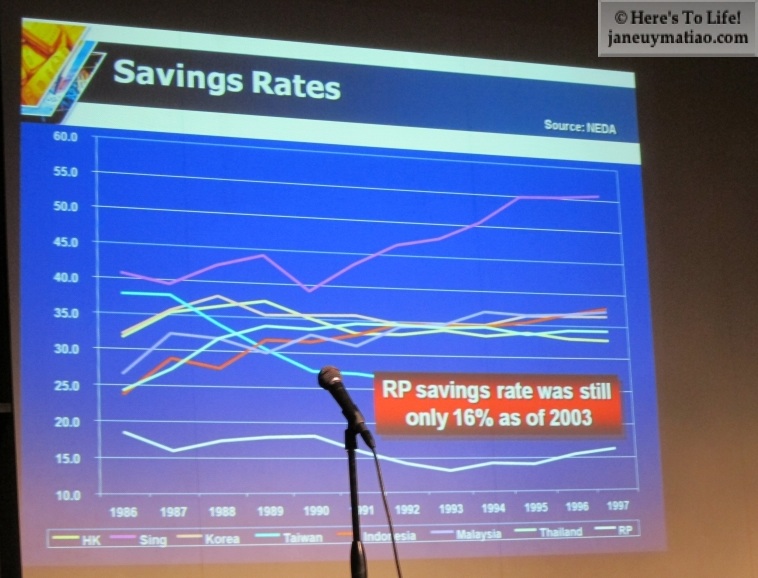

Observe the 70-30 Rule; that means — spend only 70% and save/invest the remaining 30%. Randell showed some statistics of savings rates in Asia.

Bottomline: While we save, we do not save enough. We’re only at 16% savings rate! And even that 16% savings, Randell said, is not invested in high-yielding products but placed mostly in savings accounts.

These interesting statistics reflect where the Pinoy’s spending priorities are and account for the low savings rate:

* The average Pinoy will change his cellphone every 8 to 12 months. Many Pinoys choose to forego eating to buy cellphone load.

* 4 of the largest malls in the world can be found in the Philippines. In other countries, museums, outdoor spots and art galleries remain popular places where people go on weekends and holidays. Here in the Philippines, a great number of Pinoys prefer to go to malls. We are slowly becoming a country congested with malls.

Increase one’s cash flow by building more competencies. Randell explains it this way: one has the propensity to earn more if one has more than one skill. It means that we should invest in ourselves. Let’s look around and try to learn new skills. We should try to get rid of a mindset like “Once a <profession>, always a <profession>”. A domestic helper can learn new things like learning how to be a nanny. A jeepney driver can learn new mechanical skills. An office employee can train in another area. Even stay-at-home Moms can pick up new skills off the internet.

Control the desire to spend. In the end, it is really all about control – controlling the urge to spend, controlling the urge to keep on acquiring. There is a name for this ‘ailment’. It’s called G.A.S. (short for Gear Acquisition Syndrome). For women, it is the urge to continually buy clothes, shoes, makeup and all those girly stuff. For guys, it’s gadgets and toys for the big boys.

Maybe we really need to be conscious of the huge difference between the WANT and the NEED. Most times, if we list our purchases, we’d find in there a lot of WANTS that are really NOT NEEDED.

Here’s a slide that shows different steps to financial security:

I like how Randell used an accounting equation to show the real mindset that allows someone to set aside money for investing.

In accounting, we always say Revenue (-) Expenses = Savings. But when expenses are not controlled and continue to increase, the amount left as savings shrinks proportionately.

What if we are able to turn this equation around to read like this instead?

Revenue (-) Savings = Expenses

Then it creates a conscious effort to set aside an amount for investing and only whatever is left after forced savings becomes disposable income.

Start now. Build your financial nest. It does not matter how much you earn. What matters is how much you set aside for investment and savings.

galing……