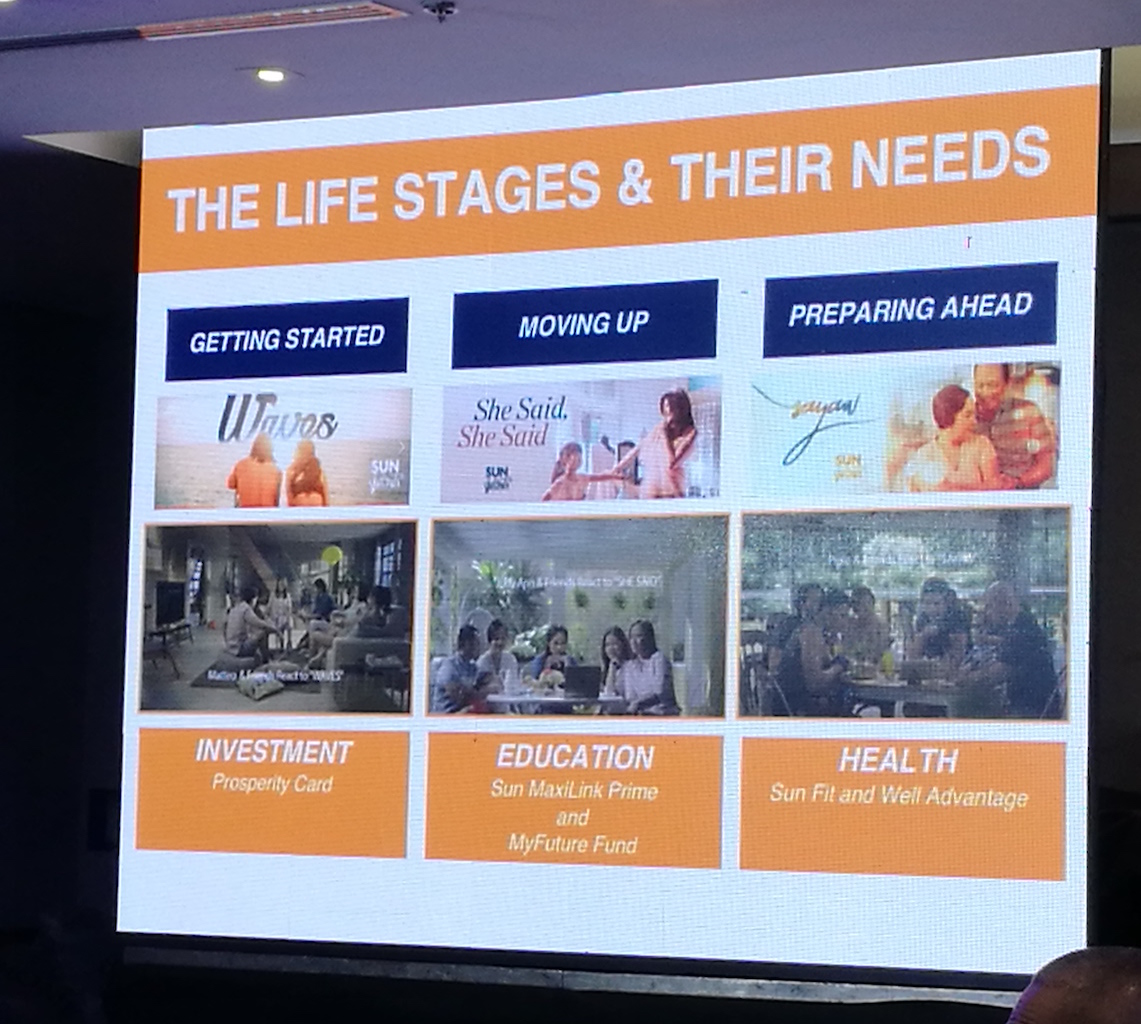

Most people who invest in financial products and buy insurance are in any of three stages in life: 1) starting to build a financial nest at the start of one’s career 2) growing wealth as one moves up in his career and has a family by then, and 3) preparing ahead for one’s senior years when the propensity to grow wealth starts diminishing and health-related expenses go up.

If you are one of these types of investors, you are in a good place. But…did you know that there is still a fourth life stage and yet, so many Filipinos miss out on preparing amply for it and it has a huge tax impact on the heirs? Here’s something to think about…

Did you know that a good chunk of your estate goes to taxes? Are your heirs going to be liquid enough to pay for the estate taxes due? Will everything you have worked for end up in their hands as you wish or as frozen assets that they cannot transfer and use?

Only two things are certain in life: death and taxes ~ Benjamin Franklin

Even in death, taxes are a grim reality. Well guess who the “Number One Heir” is to your estate — not your loved ones but…the government! Yes, the government is likely to end up with the largest piece of your estate than each of your heirs.

Here are some of the realities your heirs will face after you are gone:

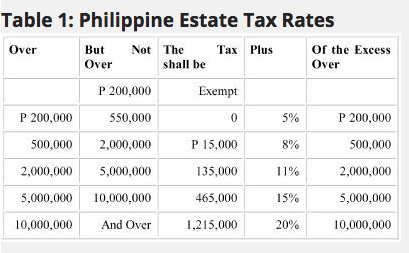

1. Unless your total estate is valued at not more than PhP 200,000 (which makes your estate tax-exempt), your heirs will need to pay between 5-20% of your net estate. Take a look at the table below of Philippine estate taxes. If your net estate, for example, is PhP 5 million, your heirs need to cough up almost PhP 465,000 in estate taxes. Once your net estate hits PhP 10 million, estate taxes are at least a whopping PhP 1.215M! Anything over PhP 10 million is taxed at 20%.

2. Your heirs have only six (6) months from your death to file the estate tax return and settle the taxes due.

3. If your heirs are not that liquid, and you failed to leave them with enough cash to cover estate taxes, chances are they may have to sell valuable properties at lower-than-fair-market-value prices just to meet the 6-month tax deadline.

4. Even worse, failure to pay within the stated deadline will subject your heirs to a 25% surcharge and 20% deficiency interest PER ANNUM!

Many heirs are actually shocked at how much they need to shell out even before their parents’ properties can be transferred to them.

Lack of estate planning – a sad reality in the Philippines

Unfortunately, the lack of estate planning and poor tax compliance is commonplace in the Philippines.

In one article I came across recently, Deputy Speaker and 2nd District of Marikina City Rep. Romero Quimbo was quoted as saying, “After deducting the registered estate taxpayers from the total deaths in 2013, data show that 94 percent did not file the required estate tax return. Even if the estate is exempt from taxes, the filing of a return is still required under the National Internal Revenue Code (NIRC).” Rep. Quimbo was further quoted by the same article as saying “Just looking at the number of deaths that year and looking at the estate tax filing, which is needed to be filed over a 120 day period, less than 7.2 percent actually filed for estate tax filings with the BIR.”

Early this year, the House of Representatives passed two bills: HB 4814 proposed to grant amnesty in the payment of estate taxes for taxable years 2016 and earlier while HB 4815 proposed a single estate tax rate of 6%. The house bills have not yet passed into law as of this writing. However, the bill proposing a flat rate of 6% on net value of the estate is part of the government’s Tax Reform Program – Package 1.

Why is estate planning not top-of-mind for many Filipinos?

Situations can be different but offhand, I can think of several possibilities:

- Culturally, Filipinos do not like to prepare for death nor talk about receiving ‘pamana’ (inheritance) while the person is still living . Estate planning, for some, is like preparing to die.

- Many times, death is preceded by medical expenses. Then there are also the funeral expenses. Even before they are able to think of estate taxes, families are already financially depleted. No wonder non-compliance with tax requirements is very high.

- Some see estate planning as a concern “only of the rich”. They fail to see that “estate” is anything of value that you plan to pass on (including investments, bank accounts, vehicles, and even valuable paintings) and which may be taxable.

- Many retirees do not know that insurance can be used for estate planning purposes; even retirees who are familiar with investment products know mostly about those that build and grow wealth, and not those that preserve wealth (like an estate plan does).

Sun Life’s latest campaign helps retirees preserve their legacy

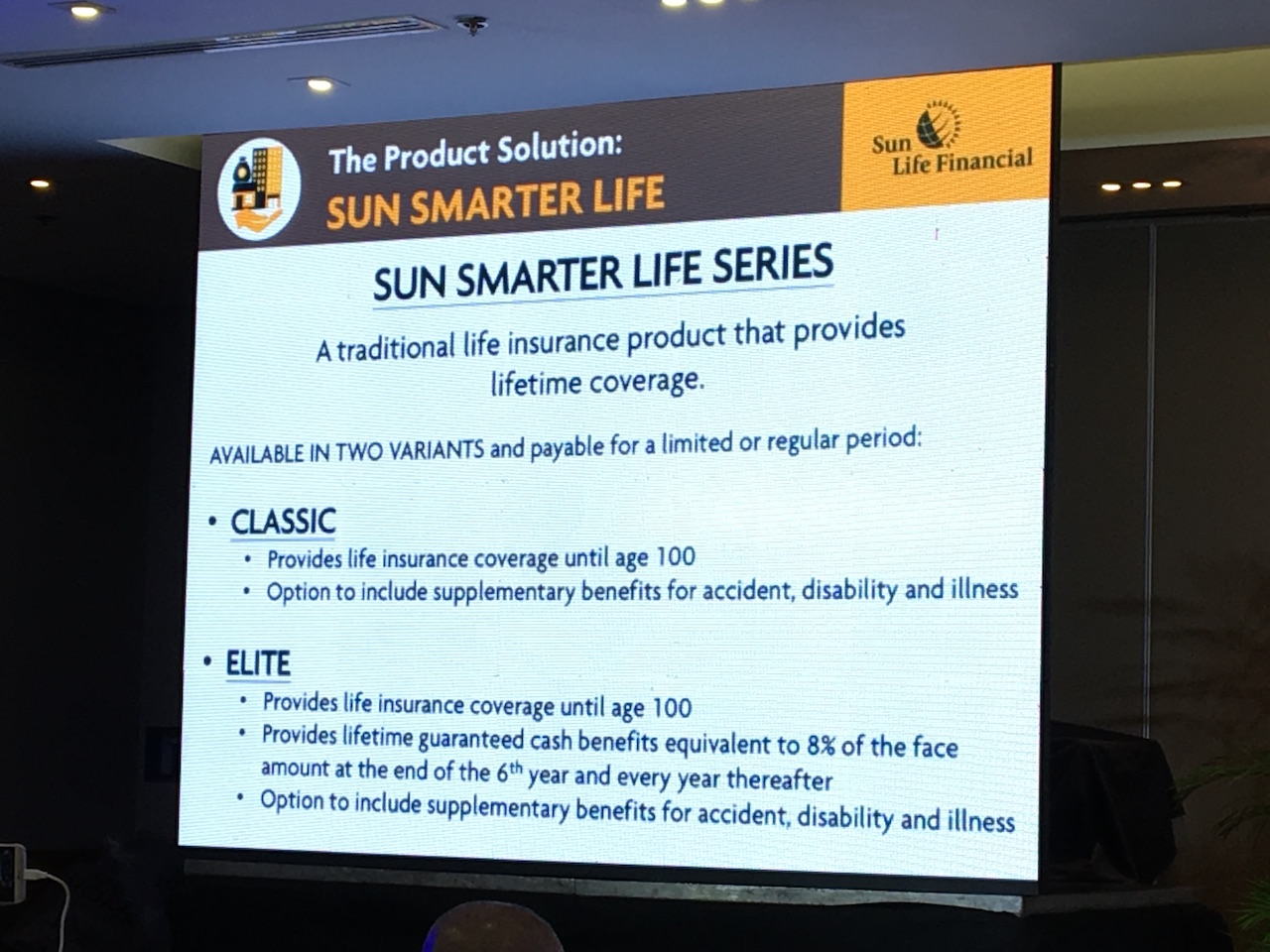

Sun Life is hoping to reverse this trend and start empowering retirees through its SUN Smarter Life protection product.

SUN Smarter Life provides double life insurance coverage until age 100 (allowing Filipinos to maximize their coverage throughout their lifetime). What is great about insurance is that once the policy becomes active and something happens to the insured, the beneficiaries can get the FULL benefits of the policy. Plus, if the beneficiaries are designated as irrevocable, the proceeds are not taxable.

SUN Smarter Life also provides living benefits for emergencies or in case the insured becomes terminally ill. Supplementary benefits may be added to the plan for a minimal amount to provide additional protection against contingencies such as accident, disability, and illnesses.

SUN Smarter Life comes in two variants and payable for a limited or regular period: CLASSIC is everything I already described while ELITE includes all the Classic features PLUS guaranteed cash benefits. Each Guaranteed cash benefit is equivalent to 8% of the face amount and will be given starting at the end of the 6th year and every year throughout your lifetime.

If you have been getting insurance while you were building and growing wealth, you can surely use insurance to preserve that wealth and mitigate the effects of estate taxes on your heirs as well!

There are two ways to use SUN Smarter Life:

- You can have a financial advisor help you estimate your net estate value so you can get the equivalent coverage. In this way, your heirs can use the proceeds to pay off the estate taxes when the time comes;

- You can get this type of insurance as your pamana (inheritance) itself to your heirs.

Watch Mylene Lopa, Chief Marketing Officer of Sun Life, explain why they decided to make estate planning a campaign and how SUN Smarter Life can help with estate taxes.

Sun Life tapped none other than recently-retired Charo Santos-Concio as the face of a SUN Smarter Life client. Charo has made an impact in the entertainment industry almost from the time she joined as an actress decades ago to becoming head of the country’s biggest multimedia conglomerate.

Despite all her accomplishments, what Charo continues to hold most dear are the values she hopes to pass on to her loved ones. She now exemplifies the confident retiree who is able to pursue her other life passions including activities such as parasailing, painting, yoga, and spending a lot of time with her two granddaughters.

I was able to get in a few minutes to speak with Charo who happens to be my college schoolmate. We belonged to different departments and went our separate ways after graduation so it was nice to learn a bit more about her life after school. It saddened me to learn that a few years after we graduated, her father passed away. But sad events can be life changing and Charo shared that losing her dad so early in life made her more conscious about building something for herself and her loved ones. She has been with Sun Life for 34 years already, having gotten her first insurance policy after the birth of her first child. By getting a Sun Life insurance policy, Charo said that she now has peace of mind that “…my loved ones will be well taken care of and will not be burdened with estate taxes.”

Her advice for young people is to “work hard, save up, live within one’s means, and not be carried away by what you have now.” She added that it is important to “plan within the context of your capacity and live the quality of life suited to your family. It takes a lot of discipline, responsibility, appreciation for financial management and the value of money.”

If you are semi-retired or already retired, you are at that stage of life where you need peace of mind and an assurance that everything you have worked for ends up with your family after you’re gone.

This event was a wake-up call as well for me and my husband. It’s a very good reminder for us to talk more often these days about our own estate planning strategy so our kids will not go through the challenges my siblings and I experienced when our parents passed on.

For more information and to contact a Sun Life financial advisor, visit Sun Life’s website at www.sunlife.com.ph. You can also find them at the following social media accounts:

Facebook: www.facebook.com/sunlifeph

Twitter: @sunlifeph

Instagram: @sunlifeph