A company called Emgoldex Philippines has been in the news lately because of a Securities and Exchange Commission warning to Filipinos that this is a pyramiding scheme.

That gave me the idea to blog about pyramiding schemes as opposed to multilevel marketing because many times, people view these two as one and the same. Not quite.

Where they look similar

Both pyramiding schemes and multilevel marketing (MLMs) have a similar triangular structure where the base gets wider as each new recruit tries to recruit other members so that they earn from their recruits.

But there are more areas where they differ…

What is being sold:

In a pyramid scheme, there is no product or service. Each recruit is expected to put in a sum of money as an investment and this is often fairly large in amount.

In MLMs, the initial cost oftentimes is a starter kit for a product or service that consists of the faster selling products plus some added miscellaneous costs such as brochures, order forms, bags and other paraphernalia that a seller may need to promote and sell the product.

Type of training:

In a pyramid scheme, there is no training. You just cough up the money and wait for the promised “return on investment” (ROI).

In MLMs, there are training programs to explain the products/ services to the members, with regular training updates.

What is promised:

In a pyramid scheme, one is promised a generous ROI that actually makes it a tempting offer to those who do not know any better. But this is made dependent on the number of recruits expected to also cough up large investment amounts. In the case, for example of Emgoldex, this article says that “investors” were promised a return of between PhP5,000-10,000 for every PhP 1,000 they put in or a return of between PhP 180,000-360,000 for every PhP 35,000. Yet, there is no logical business explanation for how the money is to be invested in order to earn profits to enable that kind of payout to investors.

In MLMs, while you get a “commission” from the sales of your recruits down the line, the existence of a product or service to be sold means that even without the commissions, you can earn as much, or even more, than those above your level, with enough effort.

Where do earnings come from:

This is where a line is truly drawn between the legitimacy of an MLM vs a pyramid scheme.

Investors in pyramid schemes are paid out of the money put in by investor-recruits down the line. This means the earliest investors are likely to get the promised ROI because there are so many investors at lower levels whose investments are funding these. These are the people singing praises and giving some form of legitimacy to the scheme because they actually get paid. Many times, these people reinvest even more money hoping for a much larger payout. Those down the line who see hear from those who get paid, start believing everything is legit and eagerly put in their hard-earned savings. Unfortunately, since this is not sustainable in the long run because those down the line will need a much larger base of investors below them. If the rate of recruitment down the line slows down or stops, the pooled money eventually dries up and those in the lower levels end up holding empty bags.

On the other hand, with MLMs, each person, regardless of where he/she is in the pyramid level, can earn solely from efforts to sell the product or service with incentive to recruit others because of the commission program. The more selling effort, the bigger the earning capacity.

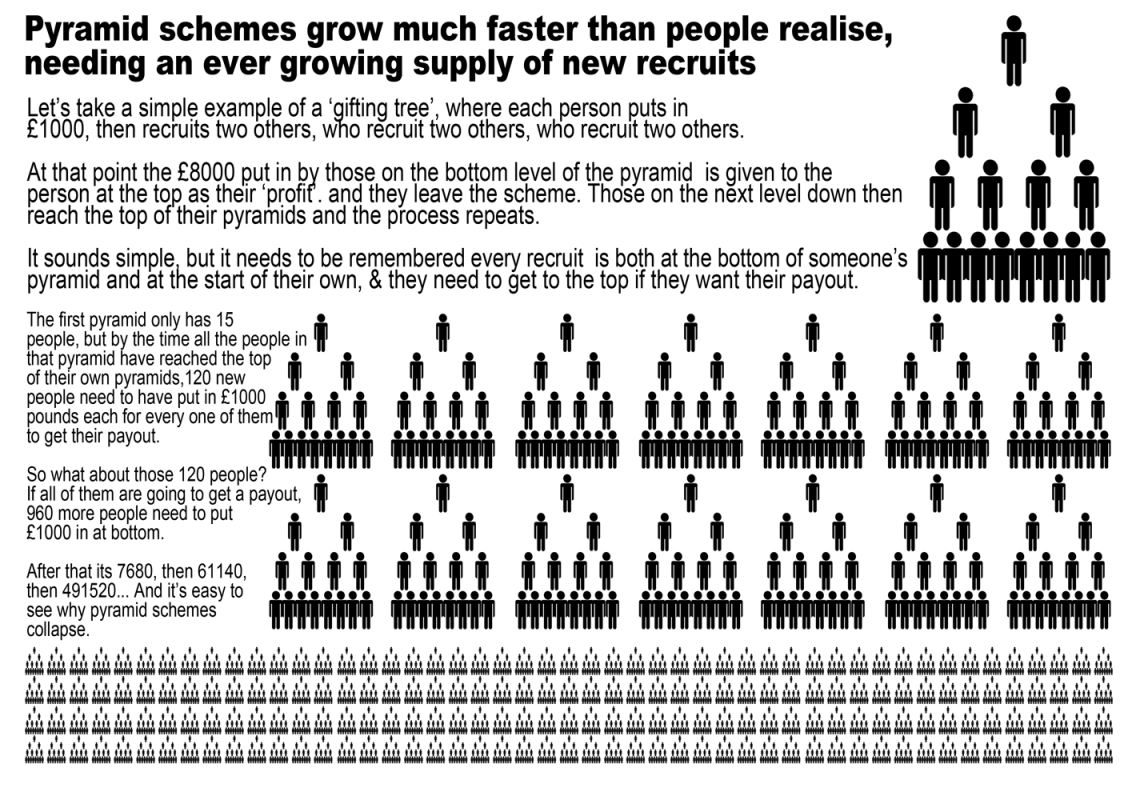

Look at this schematic of a pyramid scheme to understand why such schemes easily collapse (photo credits to Devon and Somerset Trading Standards):

Many pyramid schemes have no legal presence (no SEC registration) and are often found online. Their sites can look very professional, with assurances of well-invested funds. In case of doubt, try to contact them, check if their office address actually exists, and look for a valid SEC registration. Even companies registered abroad but are selling investment vehicles in the Philippines need a license from the Philippine SEC to operate here and offer their investment vehicles to Filipinos. If such a company is registered in places like Seychelles, an island nation just off Africa, know that places like these are known to be tax havens and a paradise for laundering dirty money.

MLMs generally have a legal presence. The reason why they use the MLM approach is oftentimes to cut down on advertising expenses. Instead of spending hundreds of thousands to millions to spread the word of their product/service, MLMs would rather train individuals to do the selling and spread the word; in turn, these people get incentives from product sales as well as the commissions.

What to do if you are ever offered anything that looks like a pyramiding scheme?

1. Check if there is a product or service to be sold. If yes, it is likely an MLM. If all it requires is for you to ante up a large chunk of money and trust them to do the investing for you, think again. Money does not multiply that easily.

2. Even the best investment fund programs will not promise the doubling or tripling of your investment in a short span of time. Interest rates and investment strategies just can’t support that. Just think of it — how can anyone ever promise a doubling, tripling of your money if large businesses operating in the country, with very astute fund managers, are not even able to do so? Go by the golden rule and your instincts: If something is too good to be true, it usually is.

3. Do some background checks on the legitimacy of the company. If they are serious about getting the money of Filipinos and investing these, they will secure the proper licenses and registration permits from our local SEC, BIR, etc.

In the end, it pays for all of us to be a little bit more financial literate. Read up on financial matters (even if you are allergic to numbers, you will be thankful down the road for this knowledge). The Philippine Stock Exchange (PSE) gives free lectures nowadays on stock market trading. Bank marketing personnel will gladly sit down with you and discuss their investment vehicles for whatever budget you have. Take the time and ask questions to brush up on what’s out there. Attend financial seminars being offered by financial planners. Even the internet has so much information you can read up on for starters. Just do not easily plunk down your hard-earned savings to strangers promising hefty returns.

Can I ask? if you were offered emgoldex investment, would you go for it? are you willing to sacrify the trust of those 2 persons that you’ll recuit?

From what I have been reading about Emgoldex and based on the warnings by the SEC, I will not go for it. I hold to a personal rule that if the rate of return is significantly higher than that of existing investment products out there, I would be very careful and look at whether it is a sustainable product.

hi mam what about #SUCCESS200 do you heard about it? they have no training but they have products to sell.

Hello Remz. Thanks for asking.

What is important is to find our if they have a specific SEC license to solicit investments from the public. Some pyramid scams come from companies who hold an SEC registration but are only licensed to trade or sell products, NOT solicit investments. So an SEC registration alone is not enough. A friend on a radio station will be talking to an SEC director for investor protection. I strongly suggest you hold off putting in any money until we get more details.

hello…no update about success200 yet?….they claim to be legitimate, with sec registration (which cannot be read), business permit issued at quezon city (they are operating nationwide) and so on and so forth…they are luring people to invest php1,800.00, get 2 recruits and in return they will earn Php10,000.00 on their first exit and unlimited Php9,000.00 thereafter. Their website specifically stated that earning and compensation are based on sales and distribution of products but their advertisements on particularly on facebook showed otherwise. Maybe you know anyone at SEC so they could closely monitor this company before they could victimize more innocent people who just want to earn more income not knowing that they fall prey on their baits. thank you.

It looks like the SEC advisories are not fast enough to cover all such scams coming up. I would stay away from anything that requires one to get recruits for every investment slot. It is likely that the company is using recruits’ investments to pay off earlier investors. It won’t be from company earnings. No company can earn that much in returns to investors that quickly. Rather than wait for SEC to name them, it is better for people to recognize the scams because they take on similar forms.

I’m updating my reply to Jenner’s comment because SEC now has an advisory on Success 200. See http://www.sec.gov.ph/notices/advisory/2015_SEC%20Advisory_Success200_Intl_Mrktg_Corp.pdf

In fact, here is another company also on the alert list: http://www.sec.gov.ph/notices/advisory/2015_SEC%20Advisory_FLAG_Prosperity_Marketing_Inc.pdf