Yes, I am beginning this article with that statement. I don’t believe that the paluwagan system is a good mode of saving. Have you ever been invited to join one? Been tempted to try? I did – a long, long time ago. And that is the reason for writing this. Read on and I’ll tell you why.

How does ‘paluwagan’ work?

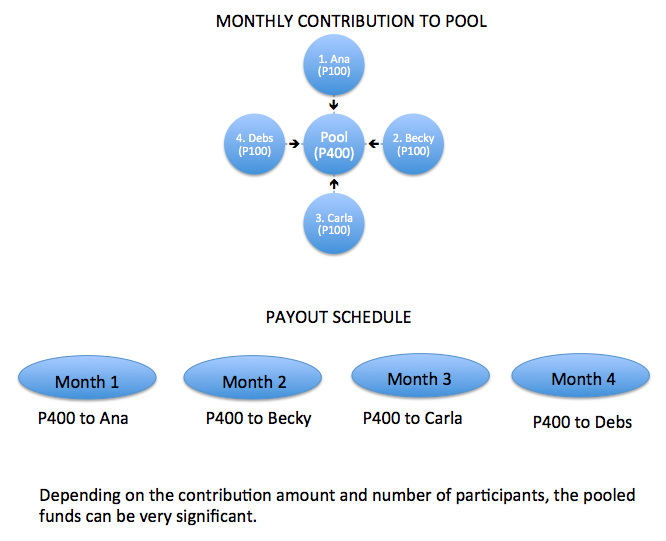

* A group of friends or work colleagues agree to contribute a specific amount on a specific day. A collector is designated from among the group members to collect from everyone and the money goes into a pool of funds. To illustrate, let’s say there are 4 friends, each one putting P100 into the pool each month.

* Based on a raffle system, each one gets a number indicating when he/she gets the paluwagan. At the end of the first month, the one who is first in line gets the pot, P400. In this case, that is Ana.

* The next month, everyone contributes P100 each again and the next pot of P400 goes to the second in line – Becky. And so on…

At first glance, it looks like a good way to force yourself to save. But who is kidding who.

You do get a windfall on your turn. But for the rest of the months, till it is your turn again, you don’t get anything and yet you need to contribute to the pot. Gutom!

The first person to receive the pot is risk-free. But what about the rest? Well, the risks increase the further down the line you are. The one bearing the most risk is the last person to be paid the pot.

What risk?

A paluwagan operates primarily on trust among the participants.

1. The collector who holds the funds must be trustworthy. There is a risk though, if the pot is quite large, that the collector could run away with the pot.

2. One or more members of the paluwagan may encounter difficulties in meeting the obligatory contribution. That puts the risk on the member set to receive the pot for the period that he will get less than what is expected.

But here’s why I really don’t believe in the paluwagan system.

Your money does not grow at all!

It’s a form of forced savings but you can achieve the same thing if you exercised self will power, saved the contributions yourself, and invested them instead. Plus, you would earn interest on the investment. In the paluwagan system, unless you are the first person to get the pot and you did invest it instead of spend it, you would at least benefit a bit. But what about the rest in the group? Those who keep on contributing and contributing ahead of their turn at the pot often experience negative cash flow and only find relief when they get the pot.

What you may not often realize is that the cash relief on your turn is just a return of all your earlier contributions and an advance of future contributions, nothing more. In fact, the later in the distribution line you are, the more you lose out in terms of investing opportunities and the value of what you eventually receive has already been eroded by inflation.

Any other risks other than what I already mentioned?

Yes. When I google paluwagan, I see websites where people who are strangers to each other can join paluwagan groups, contributing as low as P100 via online fund transfer platforms. This poses an even greater risk. One, you do not know who is the fund manager or collector and it is hard to check his integrity or ensure your funds stay intact. Two, you also cannot run after the collector or any of the paluwagan members who may eventually default on the contributions.

I’m glad to have found a video of well-known financial planner Salve Duplito talking about paluwagan and she actually compares it to a pyramid scheme. Watch.

Where can you place your funds instead of in a paluwagan? Instead of pooling your money in a paluwagan, you may want to check out mutual funds or unit investment trust funds (UITFs) being offered by banks and mutual fund companies. Your money will be invested in a mix of money market placements, bonds, or equities depending on whether you are conservative or a risk taker. You have some control in defining that.

At the very least, even if your investments are not covered by the Philippine Deposit Insurance Corp. (PDIC), the institutions are overseen by government regulatory agencies, the fund managers undergo screening and performance evaluation by their employers, and periodic reports of how the funds are doing are mailed to you.

Start off on the right foot. Building your investment portfolio with credible financial institutions is the way to go. Take time as well to learn more about investment products. There are many personal finance workshops being offered these days by reputable finance planners. I personally watch ANC’s On the Money as often as I can because its episodes cover a lot of ground as far as managing and growing one’s money.