Frankly, I came to this Sun Life event thinking it was one where we would listen to financial planners give a short talk on personal finance and maybe learn about new product offerings. I never expected this event to be about ME!!! And about all of us – you and I.

I sat at a table near the front and struck up a conversation with a guy seated near me. As it providentially turned out, he was Ara Laraya, the financial planner behind the Pesos and Sense blog that I have come across time and again in readings. And he was our speaker for the day too! More on Aya later…

The event opened with Riza Mantaring, President and CEO of Sun Life, welcoming all the bloggers. Ms. Mantaring spoke about Sun Life’s 5-year growth plan dubbed “Rise PH” which aims to serve 5 million clients by year 2020. She said “Despite the bright prospects that the country’s economy has, prosperity still hasn’t trickled down to the more disadvantaged sectors of society. We have to address this.”

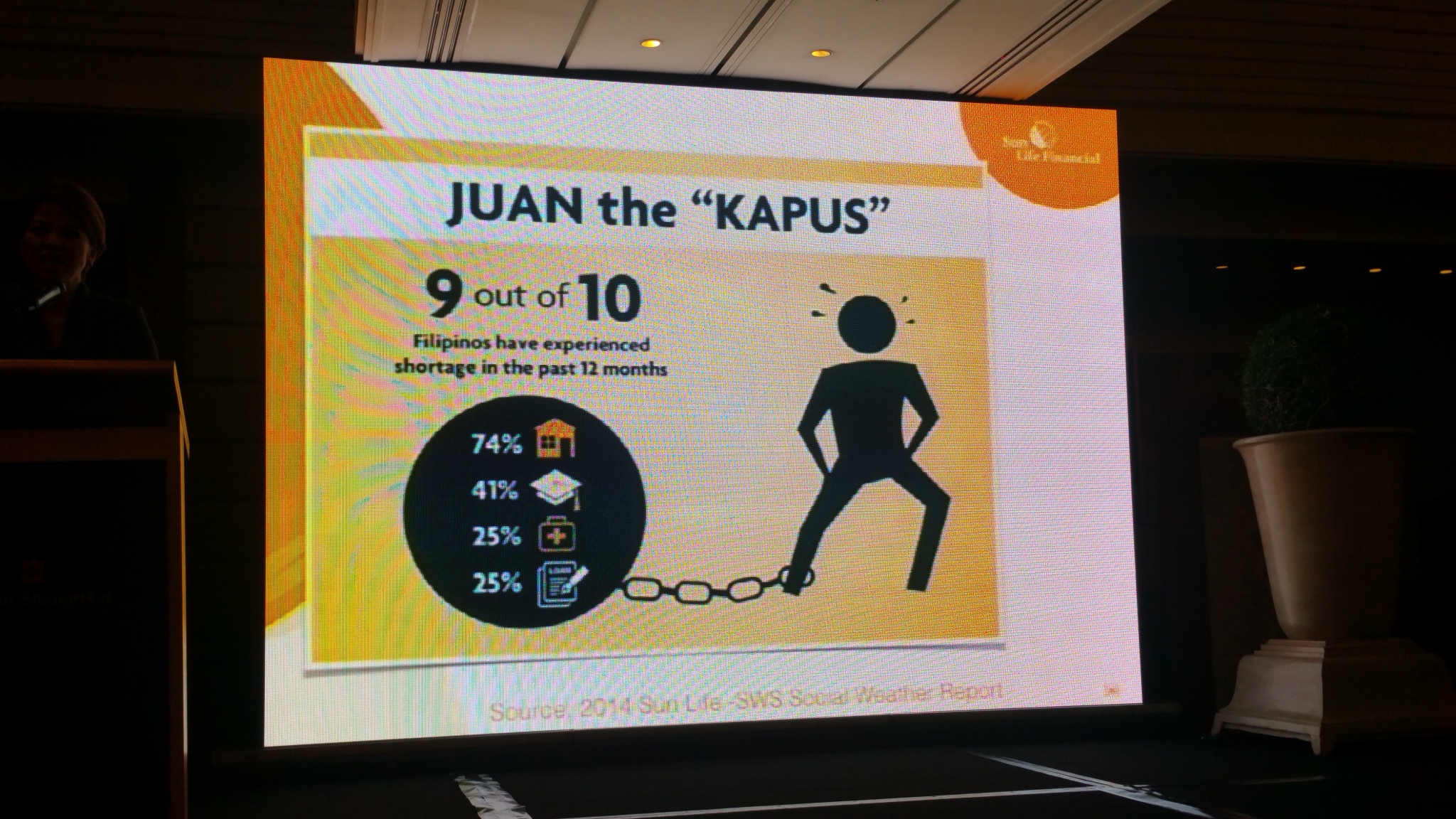

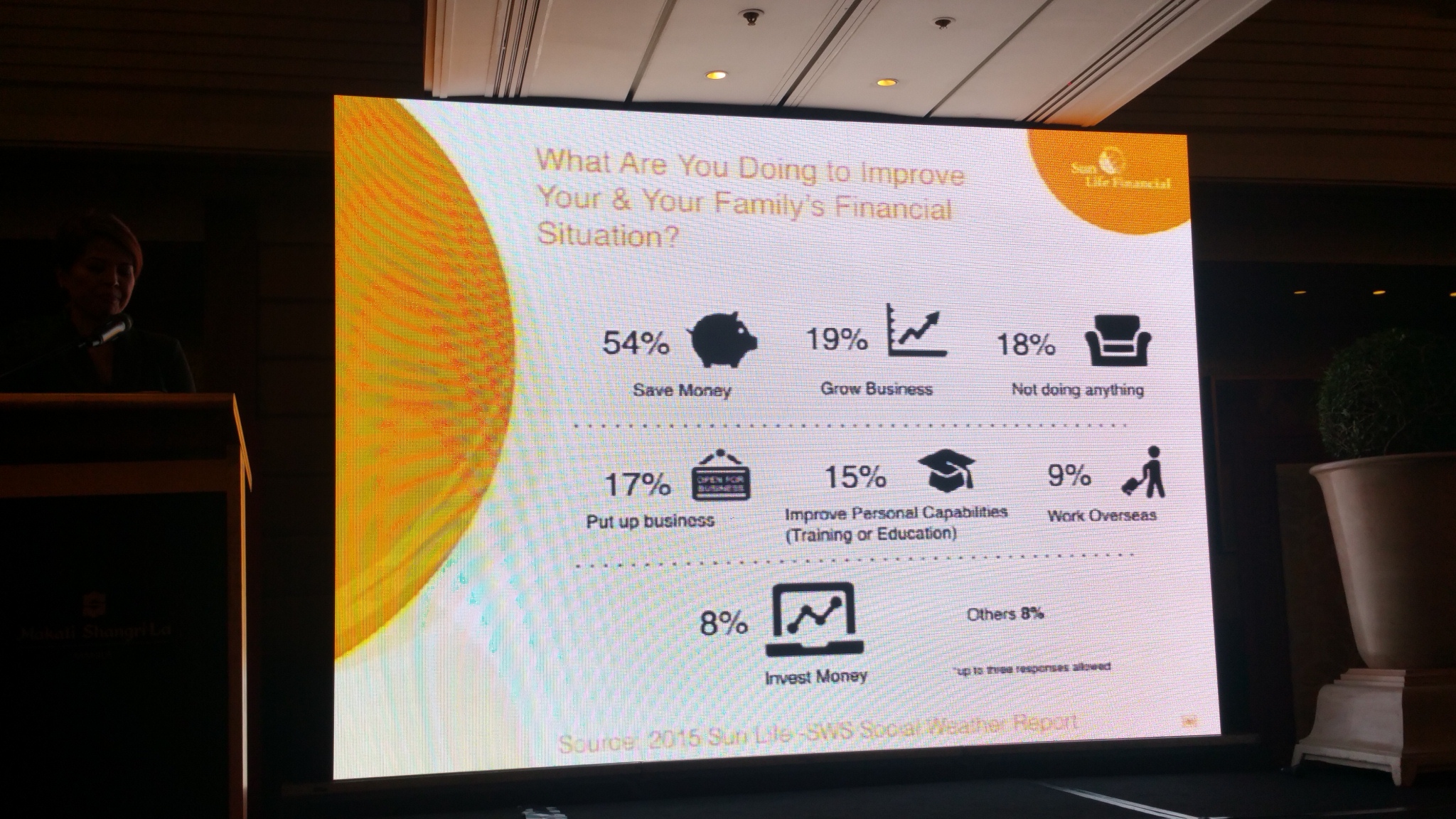

Mylene Lopa, Chief Marketing Officer of Sun Life Financial, gave us some alarming demographics, based on an SWS study that Sun Life commissioned, about the life of ‘Juan’ (and ‘Juana’) in the Philippines.

These statistics really jumped out at me and I have to be honest, I felt a sudden sense of urgency to DO SOMETHING IN MY OWN HOME. Children now will just carry on from what they learned from their parents and if we do not disrupt bad habits and transform Filipinos’ investing mindset, how do we give the next generation the needed advantage of knowing how to manage their own money better?

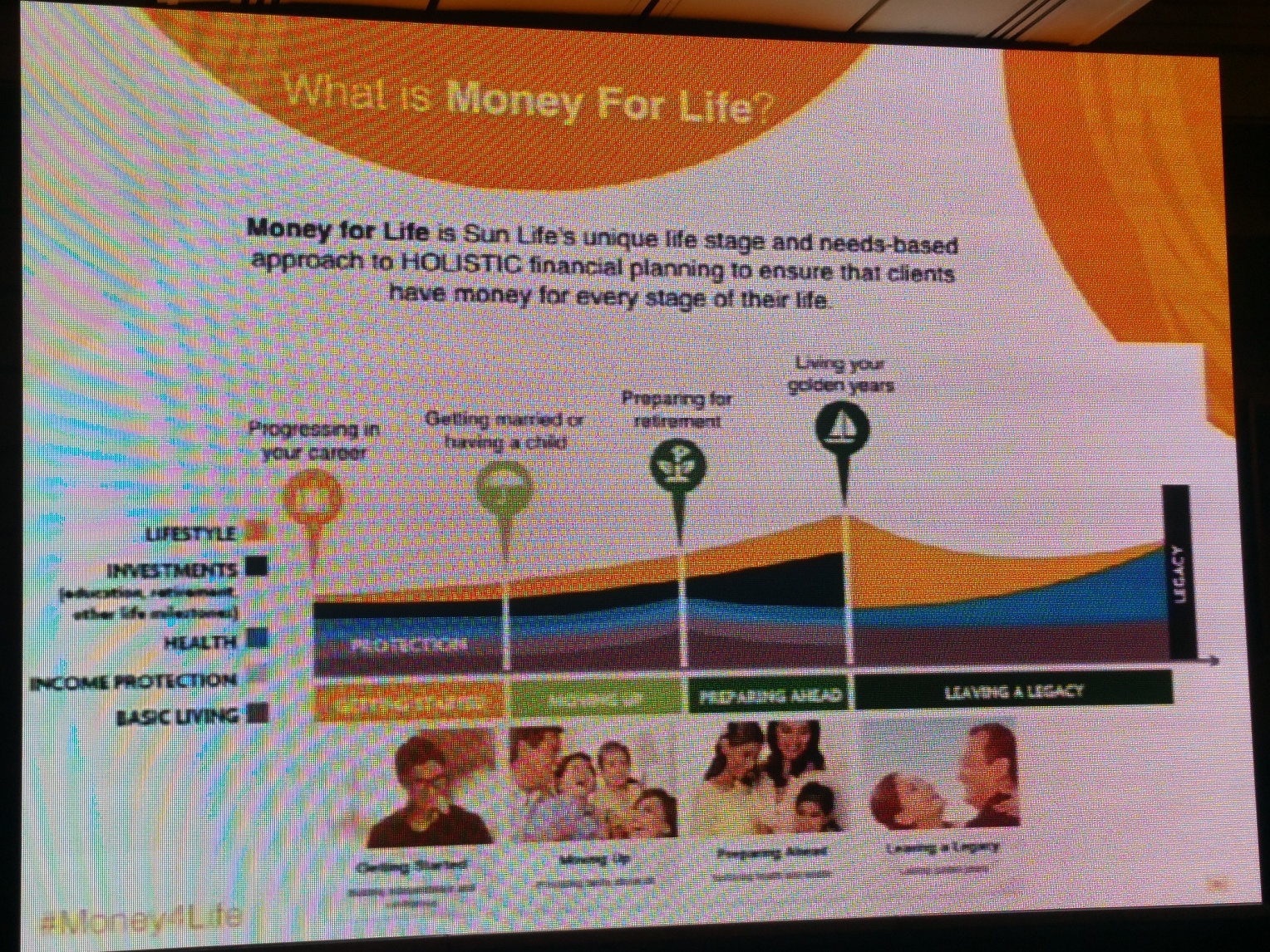

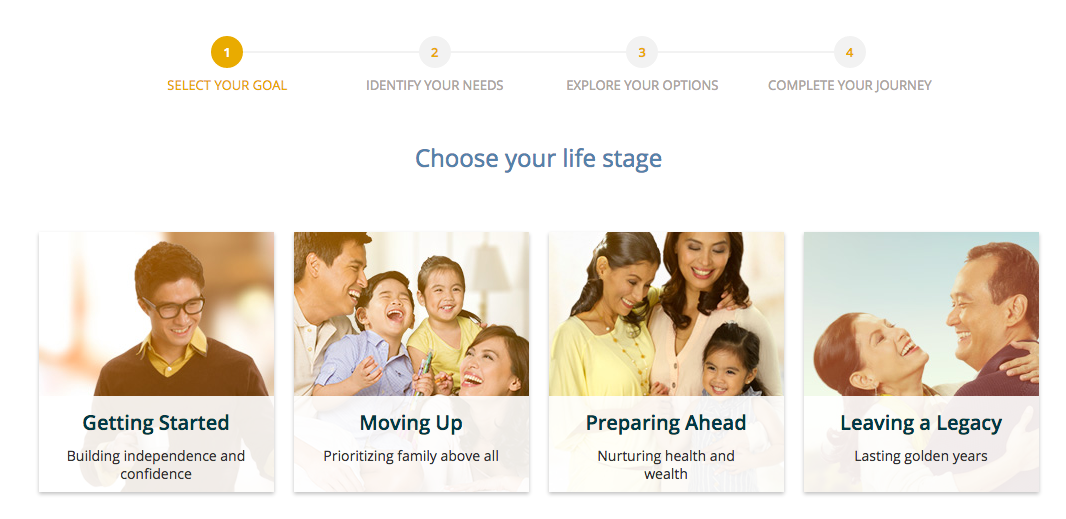

Sun Life, in response to the study, created a holistic financial planning program, Money For Life, so that its clients at any stage of life could achieve the financial goal they set out for themselves. Money For Life is customizable and comprehensive; it covers 4 major life stages: 1) Getting Started (those just starting their careers, 2) Moving Up (for those getting married or having a child), 3) Preparing Ahead (retirement plans), and 4) Leaving a Legacy (living your golden years). You could start at Stage 1 and work your goals up into Stage 4. Or, you could be somewhere in the in-between stages already and still be able to set goals till Stage 4.

To inspire the public to start their own Money for Life plan with a financial advisor, we were treated to a tour of the “Bus to the Future“, a rolling futuristic van that has been making stops in different malls and campuses nationwide all throughout the month of June, which happens to be Financial Independence Month.

Inside the van, wearing a VR headset, one can watch 360-degree visual reality (VR) videos that transport them to different scenarios, depending on the life stage they have chosen. The viewer gets to live the dream for a minute to show what he/she can have with proper planning for the future using Money for Life as well as Sun Life’s life insurance and investment products.

Those unable to catch the “Bus to the Future” can go to a website, moneyforlife.com.ph, to start them off. Just choose one’s life stage, set your goals, check your options, and you’re set. From this site, you can already get product recommendations based on your answers to some questions and you can even buy mutual funds online.

A Personal Challenge Begins

I was glad to listen to Aya’s talk. He spoke about the subconscious, inner talk that drives our conscious actions. They agree pretty much with what I’ve been learning in my yoga and meditation practice — our subconscious is what makes us act about 90% of the time, not what we consciously think.

Aya threw out some words at us and made us classify them into Bida (hero) or Contrabida (villain). Can you imagine that the words “money” and “wealthy” were associated with Contrabida? If we grew up thinking that to be wealthy would make us bad, would we actually want to get rich? NO! And that is what is actually manifesting in our lives. No matter how hard we try, we will not be able to gain wealth if our subconscious is self-sabotaging us.

To my surprise, Aya’s talk ended with this revelation — all of us bloggers at the event were going to be invited to attend a 6-month, one session a month, personal financial planning program sponsored by Sun Life. I did not expect Sun Life to do this for us!

But I am glad they did. I do have investments in mutual funds. And I have both life and health insurance. But I know I can still learn so much more. And if I can pass these on to my kids, that will be the greater legacy I can leave them as a parent.

So here I am, signed up for the program!!! Even in my prime, I am excited to learn and to absorb. Like a sponge. And…to push myself to really take advantage of this program, I plan to blog about the journey. Mistakes and all.

Start your own journey to financial independence. Visit moneyforlife.com.ph now.