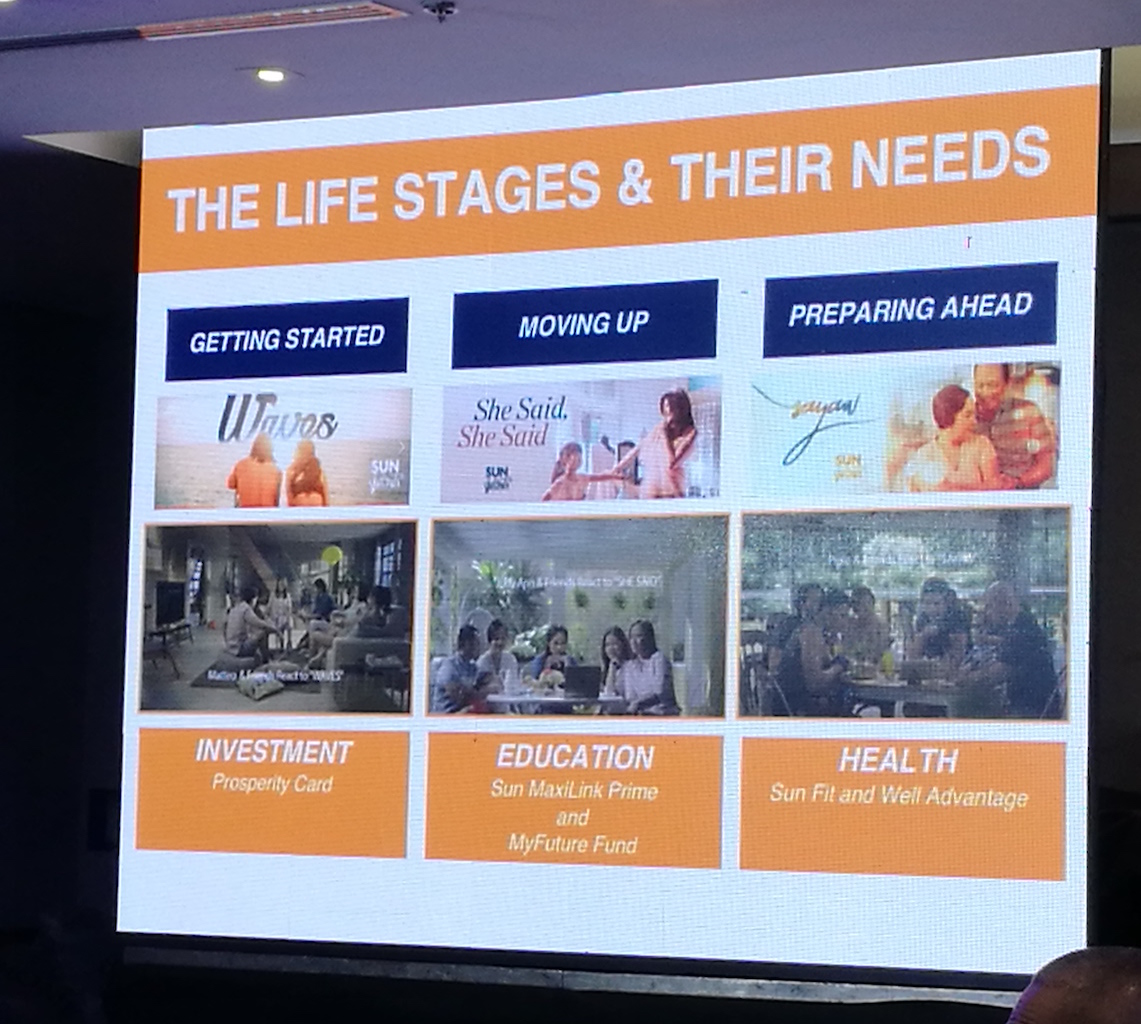

Most people who invest in financial products and buy insurance are in any of three stages in life: 1) starting to build a financial nest at the start of one’s career 2) growing wealth as one moves up in his career and has a family by then, and 3) preparing ahead for one’s senior years when the propensity to grow wealth starts diminishing and health-related expenses go up.

If you are one of these types of investors, you are in a good place. But…did you know that there is still a fourth life stage and yet, so many Filipinos miss out on preparing amply for it and it has a huge tax impact on the heirs? Here’s something to think about…

Continue reading “Preserve your legacy for your heirs through SUN Smarter Life”