The pandemic has increased the borrowing needs of many people who may have lost jobs, are under-employed, or just hit by the increasing oil prices, the accompanying price hikes, and a depreciating currency. The forced accelerated digital transformation of many companies during the pandemic have also seen a sharp rise in borrowings, with a significant uptick in online lending activity.

Incurring debt is not all bad and in recent years, we saw that it was often necessary. During the pandemic, more people incurred debts. Many of these loans were personal in nature and from online lenders. The pandemic was a very unusual emergency situation for many and people had to borrow in order to bridge their basic needs and income.

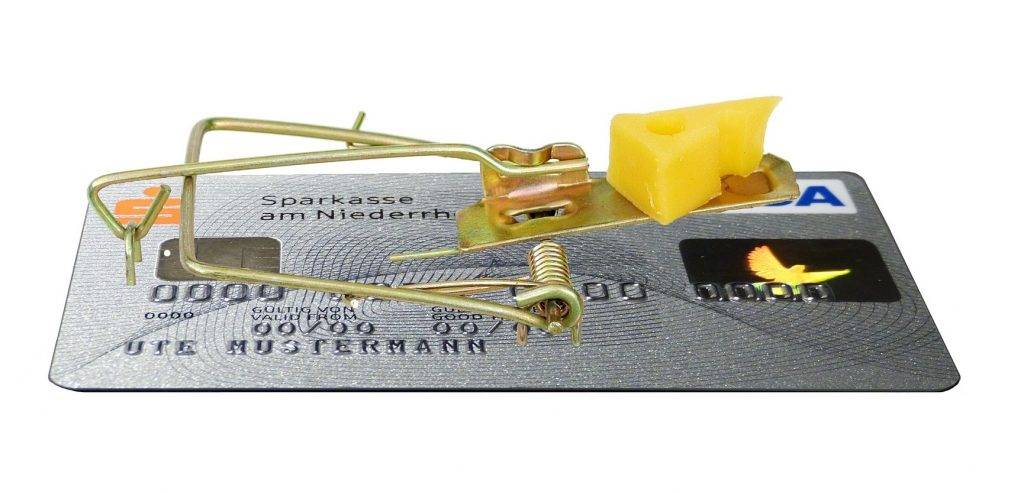

What is more important though is not totally avoiding debt but ensuring that debt does not make us fall into a spiraling financial rabbit hole, also called a debt trap — a vicious cycle where a borrower is forced to borrow simply to repay old loans. If a borrower’s income is still enough to cover the loans, this is not a debt trap but it can become one if it pushes the borrower into a situation where the payments can no longer be repaid on time and the interest keeps piling.

Don’t fall into the debt trap! Whether you currently have debt or are still debt-free, here are some tips to avoid getting yourself into deep debt.

Only use a credit card if you can pay for purchases like cash

While a credit card looks prestigious and convenient, it often gives the cardholder the dangerous illusion that he can afford things that he actually cannot afford to buy. One prudent rule is: If you cannot afford to buy something in cash, you probably cannot afford to have it charged to a credit card.

Pay credit card balance in full

Each month, pay your credit card balance in full. When you choose to pay less than the amount due, or worse, pay only the minimum amount due, the unpaid portion of what is due is treated as a loan that earns interest. If you don’t pay it off the following month, you will end up being charged interest on interest. This is how credit card balances grow rapidly. Many times, a huge chunk of credit card debt is interest and penalties.

Build an emergency fund

Regardless of your financial situation, it is important to have emergency savings set aside. Best practice calls for at least 6 months worth of your salary set aside as an emergency fund. If you still do not have that much reserved for emergencies, start today!

Consolidate several loans into one

If you have more than one loan, it is likely that they have different interest rates, payment schedules, and terms. Servicing all these can be stressful. Missing a payment can also be costly and could even affect your credit score. Consider consolidating them. One way is taking out a single loan, such as a personal loan, to pay off your other loans. You may be able to negotiate a better interest rate too.

Cut the wants; focus on needs

Examine your spending habits. Do you shop with a list or do impulse buying? These add up over time so think carefully if something is necessary before buying because you could end up borrowing just to pay for these. The more you eliminate wants and focus mainly on needs, you will improve your financial standing.

Reduce debt whenever you have extra money

The sooner you can reduce debt, the more you can save also on the interest and penalties. Consider paying off loans whenever you have extra money. When your salary increases due to a promotion or other reason, continue living off the lower salary and save the increase as emergency fund. You managed to live based on the lower salary; it is not the time to raise one’s lifestyle while still in debt.

Lastly, here’s one more word of advice…

You really only need ONE credit card

Do you have more than one credit card? Total your credit card limits on all cards. That is your potential loan exposure. Having a large credit limit can be a temptation to live beyond one’s means. They give you a false sense of security that you can afford to buy things that could be beyond your means.

I only have one credit card and I have asked the card company to bring down my credit limit to a level that is sufficient only to cover my monthly charges as well as any sudden emergency.

There are many more tips for managing debt but it is best to develop good financial habits one habit at a time. As long as you can properly manage yours, with focused discipline, you will never have to worry about falling into a debt trap.