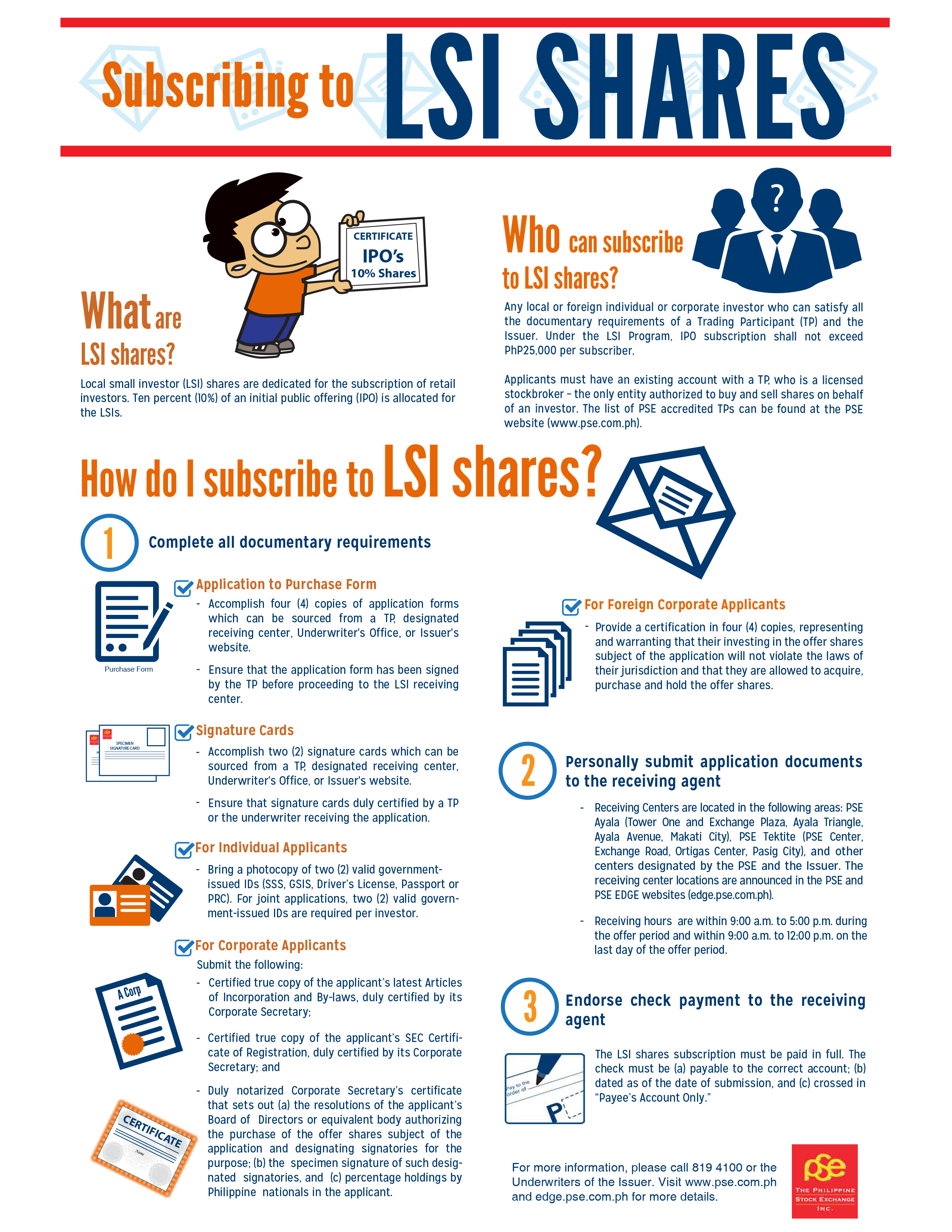

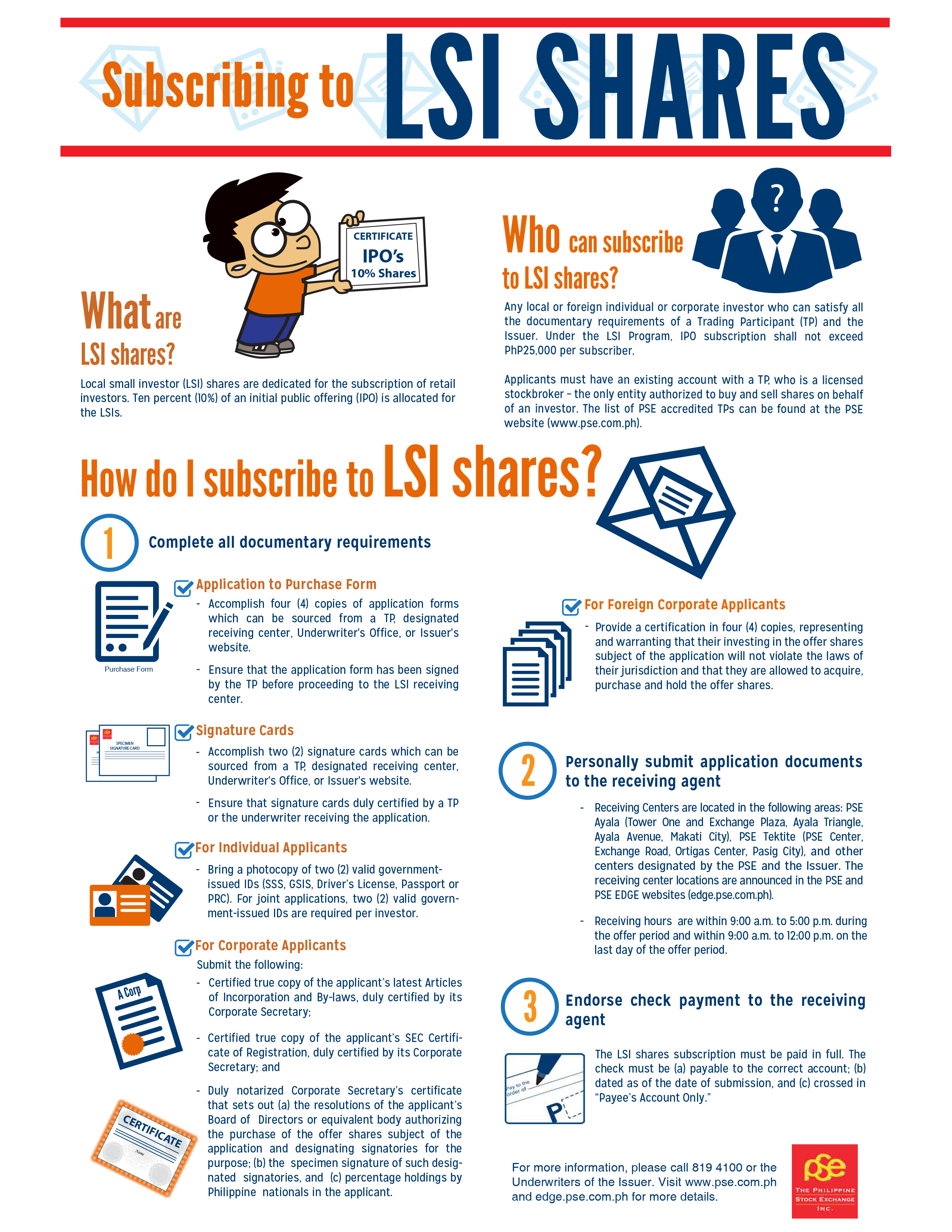

When there are popular Initial Public Offerings (IPOs), many times the shares are over-subscribed and small investors can be left out of it because stocks are usually taken by large investors through their stockbrokers. This is now addressed by the Philippine Stock Exchange‘s Local Small Investor (LSI) Shares program where investors who are just testing the waters of stock investing or who may not have that much money to buy stocks can still participate in a company IPO.

Under the LSI program, 10% of all IPOs have to be allocated for the LSIs. Any individual (local or foreign) or corporate investor can buy up to PhP 25,000 worth of IPO shares through a Trading Participant (TP), a licensed stockbroker.

Here’s an infographic provided by the PSE.

Let’s tackle some more questions that may be on your mind.

How many shares can I buy in an IPO?

It depends on the price per share for the IPO. The maximum value of your subscription is PhP 25,000. So to determine the maximum number of shares you, as an LSI, can subscribe to, PhP 25,000 is divided by the cost per share. Also, LSI subscriptions must be at least equivalent to one (1) board lot.

What if there is more than one IPO happening at the same time? Can I subscribe to both?

Yes! You can buy up to a maximum of PhP 25,000 for EACH IPO.

If I already have a broker, can I use him to buy LSI shares?

LSI Application to Purchase forms should be signed by the investor’s stock brokerage firm. So yes, your existing broker can be used to buy LSI shares.

What if I want to buy more than PhP 25,000 worth of shares for an IPO?

Unfortunately, PhP 25,000 is the maximum allowed under the LSI program. To buy more than that, you will have to go through the regular IPO purchase process. However, if you were already able to get offer shares through your broker (via the allocation per brokerage firm) but you want more, you can still subscribe to LSI.

I don’t have a checking account. Is there any other way to pay for LSI share subscriptions?

You may also pay via Manager’s Cheque.

Got more questions? Just leave me a comment below and I will hound my friends at the PSE for an answer. 🙂

Good luck and happy stock investing!