PayMaya has widened its financial inclusion. Now, Filipinos can invest in government Retail Treasury Bonds (RTBs) using PayMaya.

What are RTBs?

RTBs are medium- to long-term investments or securities offered by the government specifically to small investors. Unlike other bond offerings where the minimum placement is usually in the tens or hundreds of thousands of pesos, RTBs can be purchased for as low as PhP 5,000 during a bond offering. They are also low-risk because it is the government behind its issuance. Of course, no investment is zero risk but in the case of RTBs, it is considered low since the only time one risks losing one’s investment is if the government defaults on its obligations.

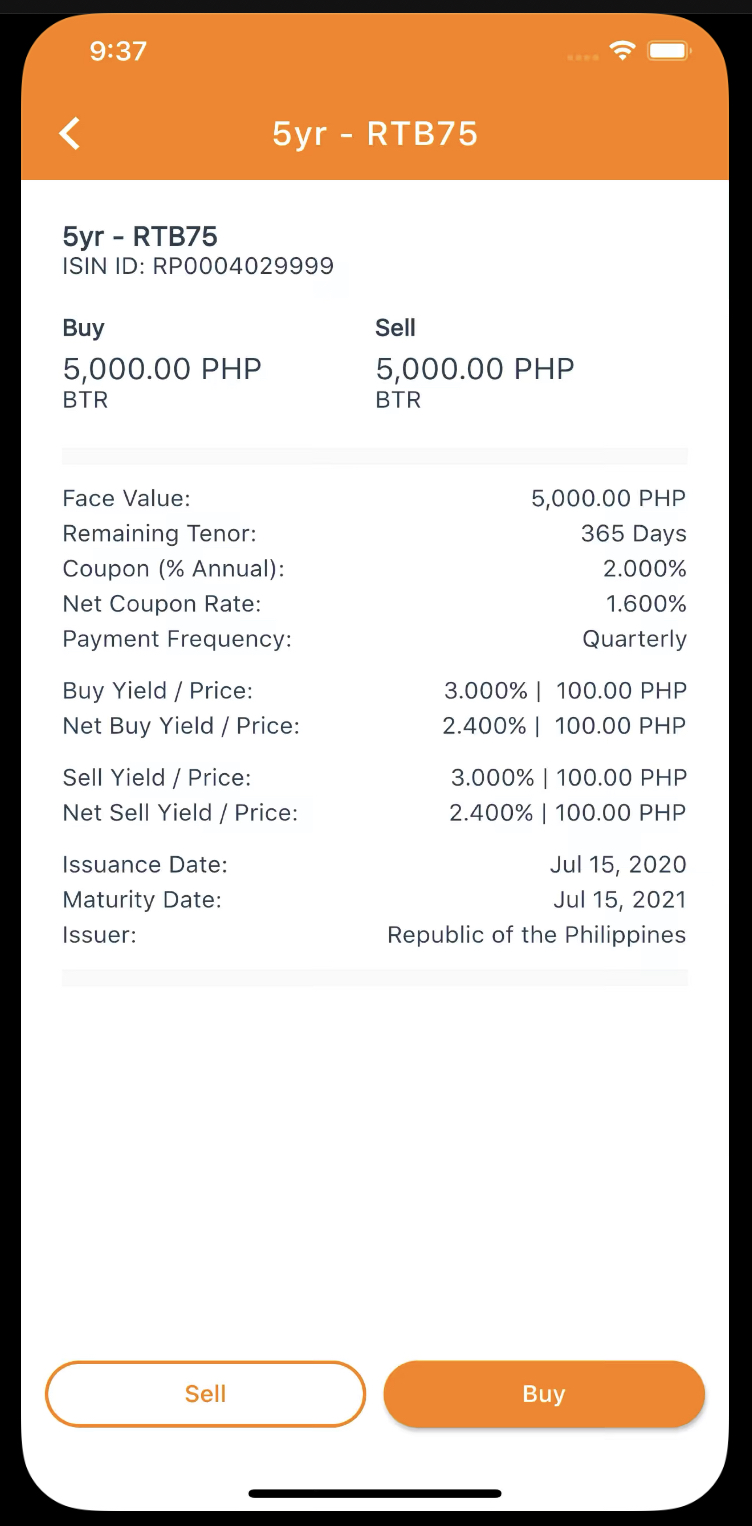

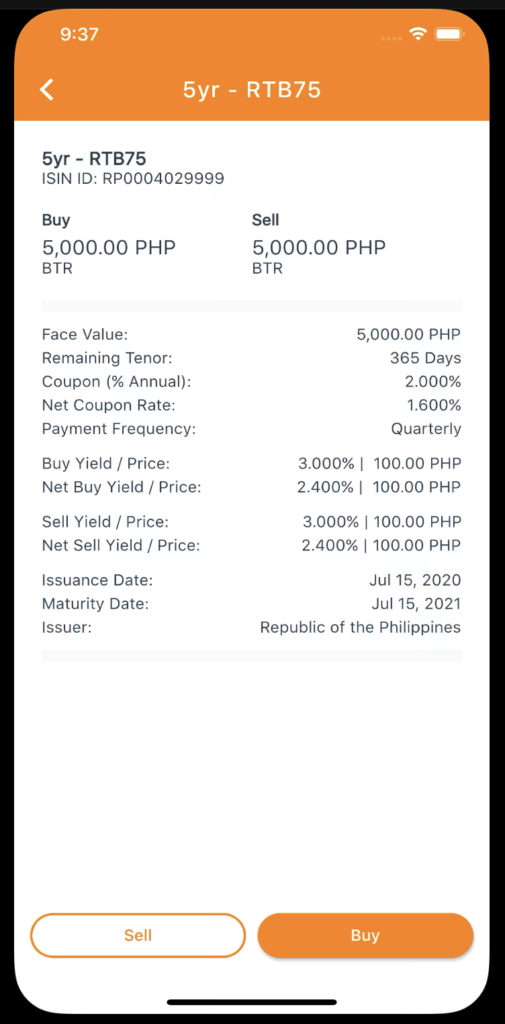

Partnering with Bonds.Ph, a new online investment platform powered by the Philippine Digital Asset Exchange (PDAX), PayMaya now allows small individual investors to avail of the government’s next Retail Treasury Bond (RTB) offering using their PayMaya accounts. The Bureau of the Treasury has allowed the Bonds.Ph app to offer its newly-issued five-year bonds due 2025 to individual investors. Prospective investors can invest amounts as low as P5,000 up to an aggregate of P500,000. The Bureau of the Treasury plans to raise P30 billion from its five-year RTBs to be offered from July 16 to August 7, 2020 and to be settled on August 12, 2020.

National Treasurer Rosalia de Leon says “We have always envisioned to provide Filipinos with affordable and secure investment instruments where they can invest and at the same time aid the government in raising funds especially at this time. So we opened up our next Retail Treasury Bond offering to an online platform like Bonds.Ph that allows investors to use e-wallets like PayMaya to invest in RTBs”.

Why Bonds.Ph?

At this point, some of you may be wondering why you need to pass through PayMaya when you can easily buy RTBs through your banks. Remember, not everyone has a bank account. In the Philippines, there is a large group of people who still have no bank account because of the stringent requirements (documentary and financial) to open one. This is where PayMaya enhances financial inclusion. Filipinos without a bank account but who are Paymaya accountholders can be investors too. But even if you have a bank account, investing through Bonds.Ph app is still convenient during this quarantine period since you can do so without having to visit your bank and fill out forms.

How does one use PayMaya to buy RTBs?

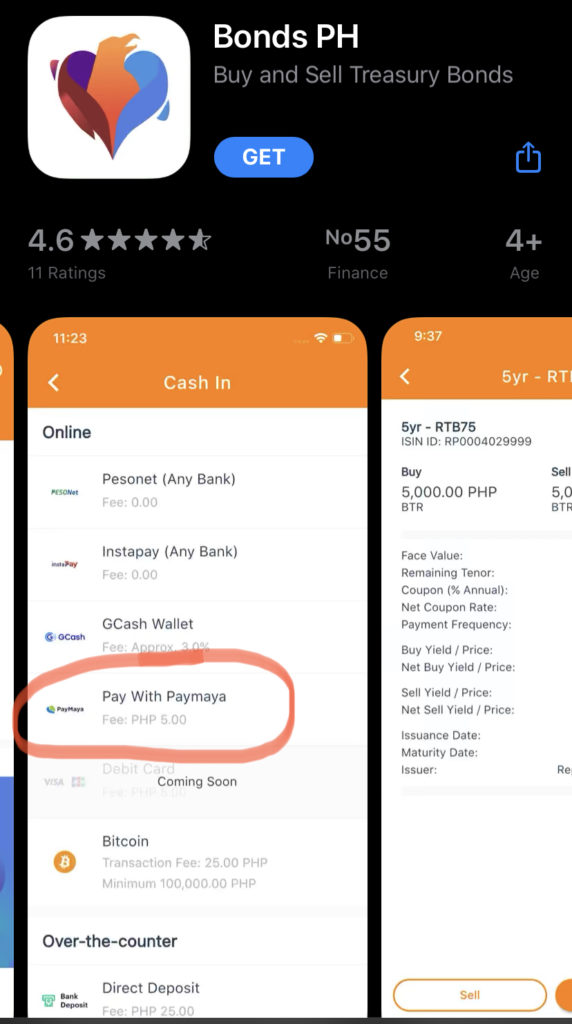

Simply download the Bonds.Ph app from the App Store for iOS users and Google Play Store for Android users, register and verify your account, and easily cash in using your PayMaya-registered mobile number.

To add funds to your Bonds.Ph account using PayMaya, simply follow these steps:

- Go to the Cash In section of the app and select Pay with PayMaya. A minimal fee of P5.00 per transaction will apply.

- Choose the amount you want to cash in, then complete the payment process after receiving the payment details in your email.

- Once your account has been funded, choose the bond offering you want to invest in, review the transaction details, and click “Buy“.

- The subscription will have an “Awaiting Subscription” status until the final allocation is completed (after offering period). All orders are considered final upon placement and can no longer be cancelled.

To check the status of your investment, click the “My Orders” button in the Bonds.Ph app. An email will also be sent to you for the notice of successful purchase of the Bond.

Once the investment has matured, you may also choose to withdraw the proceeds from your Bonds.Ph account straight to your PayMaya account. Simply choose PayMaya as the account where you will cash out your earnings. There is a minimal fee of P5 for every cash out transaction made through your PayMaya account.

There you go! Quick and easy steps to investing through an app using PayMaya!

I believe this is the future of investing as more people go online to do what they used to do physically. PayMaya has led in terms of innovating and financial inclusion and its e-wallet features continue to grow and expand.

Still don’t have PayMaya? Simply download the app using this link https://official.paymaya.com/CAK1/425eb133 and register for an account using only your mobile number.

Interesting! I’d like to explore.Have you tried this?

Not yet but I’m thinking about it.